Blockstream, a Bitcoin infrastructure firm, announced it has raised $210 million in a convertible note financing round led by Fulgur Ventures.

The funds will be used to develop its layer-2 technologies, increase Bitcoin mining operations, and expand its Bitcoin holdings.

The company aims to strengthen its position ahead of the next Bitcoin market cycle and take advantage of growing institutional interest in Bitcoin-based infrastructure.

Layer-2 Technologies and Financial Tools

Blockstream's core technologies include the Liquid and Lightning networks, which are intended to meet demand from enterprises seeking secure financial tools built on Bitcoin.

These solutions combine the public blockchain’s security with private or federated configurations, catering to business-specific needs.

Liquid focuses on enabling companies to tokenize real-world assets (RWAs), such as bonds and stablecoins, within the Bitcoin ecosystem and integrate them into traditional financial markets.

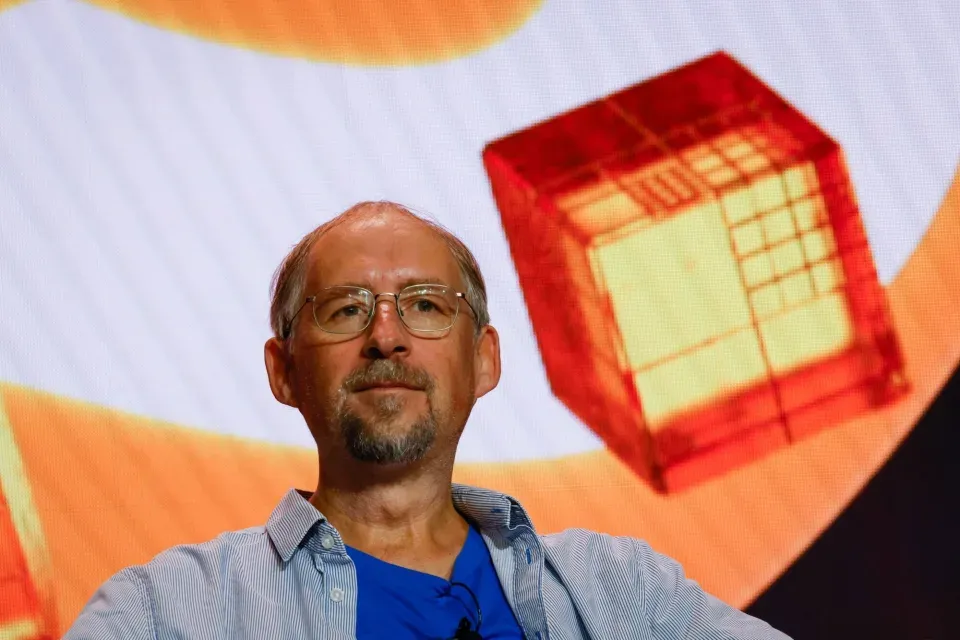

Dr. Adam Back, Blockstream’s co-founder and CEO, said the new funding would support the company’s growth and welcomed the appointment of Michael Minkevich as Chief Operating Officer to help lead future initiatives.

Developments in Tokenization

Since its launch in 2018 as Bitcoin’s first sidechain, the Liquid Network has facilitated the issuance of over $1.8 billion in digital assets, with 3,844 Bitcoin currently locked on-chain.

Operated by a federation of more than 70 members, the network enables faster, confidential settlements and the issuance of digital assets such as stablecoins and security tokens.

The network has also found traction in the $300 billion real-world asset sector.

Mexican fintech firm Mifiel recently used Liquid to issue over $1 billion in digital promissory notes, expanding liquidity options for non-banking financial institutions.

In another example, STOKR, a Blockstream partner, launched the MicroStrategy Note (CMSTR), a security token backed by shares of a Nasdaq-listed company.

CMSTR can be traded on SideSwap, a decentralized exchange built on Liquid.

In July 2024, Blockstream introduced BMN2, a hash rate-backed security token designed to comply with EU regulations.

BMN2 follows the performance of BMN1, which reportedly delivered up to 103% returns over three years.

Infrastructure Integration

Blockstream integrates its Liquid Network with the Core Lightning (CLN) implementation and Greenlight, a cloud-based infrastructure service.

This combination allows for smoother issuance, transactions, and payments involving both Bitcoin and tokenized assets.

Leadership Changes

To guide the company’s strategic growth, Blockstream has named Michael Minkevich as Chief Operating Officer.

Minkevich, who brings over two decades of experience in technology and finance, previously led product engineering efforts at Luxoft, where he helped the company expand its services and go public.

Minkevich said he looks forward to working with Dr. Back and customers to incorporate digital assets into mainstream financial operations.

Looking Ahead

With new funding and leadership in place, Blockstream plans to expand its Bitcoin infrastructure and promote tokenization efforts to meet growing institutional demand.

The company aims to develop solutions that align Bitcoin-based assets with broader financial markets, addressing both traditional and emerging opportunities.