It will not come as a surprise to you that companies raise money for many reasons, whether to grow, to invest, to innovate, to acquire, or a combination of these.

It may be novel to those reading this, although a clue lies in the description, that a Bitcoin treasury company raises money solely to grow its treasury of Bitcoin in the best interest of its shareholders.

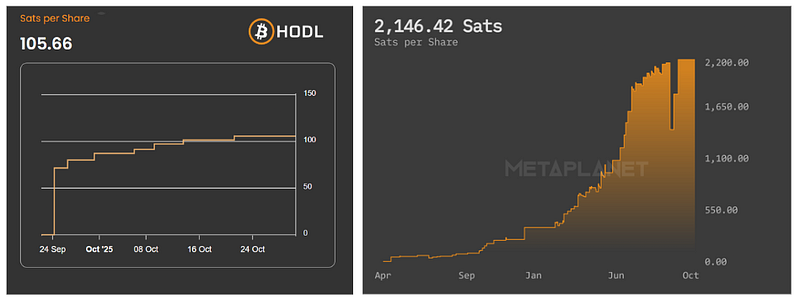

It may also surprise you to learn that the real measure of success for a Bitcoin treasury company is not necessarily its share price, but what is known as Sats per Share.

If this is an unfamiliar concept (and this is an attempt to introduce the reader), don’t worry, you are not alone.

Let’s start with one Satoshi, or “sat,” which is the smallest unit of Bitcoin, more precisely one hundred-millionth of a Bitcoin. A flat white at a coffee bar that accepts Bitcoin will be around 4,000 sats (about £3) to give you a sense of scale.

This matters because Sats per Share tells a treasury company’s shareholders how much of a Bitcoin each share represents. This is important because if that number increases, shareholders gain more Bitcoin exposure with every share they hold. This should be a treasury company’s overarching objective.

Now, here is where it gets interesting. Treasury companies measure their market value, how much someone is willing to pay for a share in the company, in relation to the sum of their assets, using a term you may or may not be familiar with: mNAV.

For clarity, mNAV in this context simply compares the company’s total enterprise value to the market value of its Bitcoin holdings, similar to how enterprise value relates to underlying assets.

If the mNAV is above 1, the market is valuing the company at a premium to its asset value. This usually means that some combination of its structure, business model, governance, management, or growth potential is adding intangible value beyond the assets it holds.

These two terms intersect when a treasury company raises capital, and it’s an interesting concept to consider, especially if you’re thinking about putting your money into their stock.

At an mNAV above 1.0, Bitcoin bought with newly raised capital is accretive to shareholders. In other words, the increase in Bitcoin held in treasury outpaces the increase in the share count, meaning sats rise faster relative to the number of shares in issuance.

In plain terms, Sats per Share go up. In less plain terms, the word for this is “accretive,” meaning a gradual growth or increase. Some call it Bitcoin yield, but that term is confusing to most.

Now, this is where it gets slightly uncomfortable for those looking through traditional fiat-coloured lenses.

Saying that a Bitcoin treasury company can raise money at any share price (as long as the mNAV is above 1.0) and still increase sats per share may sound counterintuitive, and possibly dilutive, to investors used to fiat accounting. But this reaction misses the point of a Bitcoin treasury company.

In a fiat system, companies raise money to earn more fiat, whereas a Bitcoin treasury company raises money to own more Bitcoin per share. The denominator (the shares) matters less than the numerator: the Bitcoin.

If the raise increases the Bitcoin in treasury faster than it increases the number of shares in issue, then every shareholder’s exposure to Bitcoin has grown.

The share price in pounds may fluctuate, but the Sats per Share increase, and that is what ultimately drives long-term value (in the view of the company—a view it must assume is shared by its shareholders).

This is not financial alchemy but simply the view through a Bitcoin lens rather than a fiat one, and the discomfort some investors may feel comes from trying to apply old-world logic to a new asset.

There is a balance to be struck here, and it is a personal, partly emotional, partly psychological, partly philosophical decision between valuing your investment in pounds and pence and valuing your investment in Bitcoin and sats. Zoom out and take a good look.

If Bitcoin’s value drops, the number of Sats per Share stays exactly the same, but the mNAV will usually fall. This is because the company’s Bitcoin treasury is now worth less in fiat terms, which reduces the ratio of enterprise value to Bitcoin value. In simple terms, the market premium over Bitcoin narrows, sometimes even dipping below 1.0.

That does not mean the company has become less capable or that shareholders have been diluted; it is simply the market repricing the same amount of Bitcoin in different fiat terms. The exposure to Bitcoin remains constant, and the company’s ability to accumulate more when sentiment is low can improve long-term returns once the market recovers.

It is fair to say that for most traditional investors this approach calls for a shift in mindset rather than a leap of faith.

The irony, of course, is that treasury companies often find it hardest to raise money when markets are viewing everything through fiat lenses, usually the very time when adding to Bitcoin reserves would be most beneficial.

When sentiment toward Bitcoin is low, a pound raised buys more Bitcoin, making those moments the most accretive opportunities of all.

A Treasury company must, of course, always act in the best interests of its shareholders, and that means maintaining a clear focus on both Sats per Share and share price, with the intention of increasing both over time.

It is true that these goals are not mutually exclusive, because a steady increase in sats per share provides the foundation for long-term appreciation in the share price.

So the two perspectives are not enemies; they are simply framed in different units of account. The prudent investor can take comfort in knowing that while the share price may move with the market’s sentiment toward Bitcoin, the underlying exposure measured in sats per share remains transparent, measurable, and objective.

Treasury companies combine their clearly defined, long-term view that Bitcoin will continue to increase in value over time with the belief that it will also become increasingly useful as adoption grows and legacy payment infrastructure is replaced.

A well-managed treasury company should be expert in how it uses the Bitcoin it holds, ensuring it is secure, not exposed to operational risk, and not needed for day-to-day expenses, while putting it to productive use through a business model designed to grow its Bitcoin treasury over time.

Yes, share price matters, but over the long term, share price follows Sats per Share, not the other way around.

A smart Bitcoin treasury company does not just hold Bitcoin. It builds it, one sat at a time.